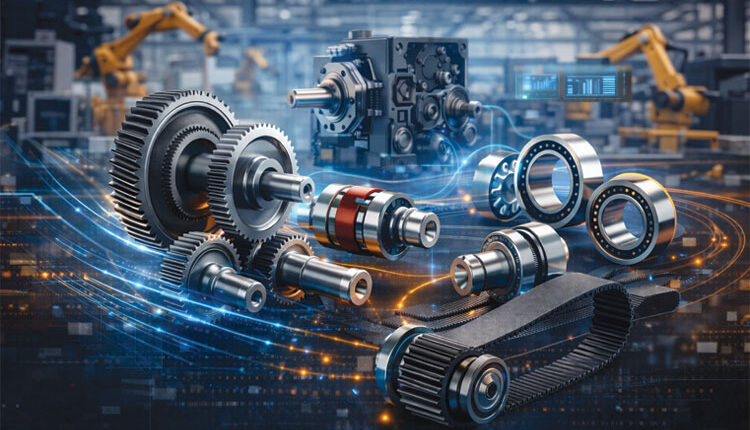

Mechanical power transmission—the gears, belts, shafts, couplings, gearboxes and bearings that quietly move the world—has entered a period of rapid, converging change. Driven by energy efficiency targets, electrification, industry 4.0 technologies and pressures on supply chains, the field is evolving from “pure mechanics” into a hybrid of materials science, electronics and data. Below I run through the most influential trends shaping design, procurement and operations today, with practical implications for plant engineers, designers & procurement leads.

Electrification and rethinking drivetrains

Electrification—both at the macro scale of grids and renewables and at the machine level in factories and vehicles—has accelerated interest in new drivetrain topologies. Direct-drive solutions (where possible) are increasingly attractive because they remove intermediate gear stages, reduce maintenance and improve overall efficiency; this is especially visible in large-scale renewable applications such as wind turbines where direct-drive and geared solutions compete on reliability and lifecycle cost. At the same time, electric vehicles and industrial electrification are pushing designers to rethink torque density, thermal management and lubrication strategies for compact, high-power gearboxes.

Practical implication: when spec’ing a new machine, evaluate whether a geared or direct-drive architecture yields better whole-life cost—sometimes the higher upfront cost of a direct-drive motor pays back through lower maintenance and higher availability.

Variable speed drives, integrated motors and system-level efficiency

Variable frequency drives (VFDs) and smart motor controls remain central to power-transmission efficiency. The trend is toward tighter integration—motors with integral drives, distributed drive architectures and smarter VFD functionality (built-in safety, embedded analytics, ride-through features). These developments let plants run motors closer to optimum operating points and reduce wasted energy across millions of kW-hours. The market and R&D activity around VFDs reflects healthy growth as manufacturers add features oriented to diagnostics and modular integration.

Practical implication: prioritize systems that support regenerative braking, integrated torque control and open communications (EtherNet/IP, Profinet, Modbus TCP) to capture energy and diagnostic benefits.

Condition monitoring, smart bearings & predictive maintenance

“Fit-and-forget” power-train parts are giving way to smart components. Bearings, couplings and even gearboxes are now carrying embedded sensors (vibration, temperature, humidity, acoustic emission) or are being retrofitted with compact IoT nodes to stream operating data. Coupled with edge analytics and cloud platforms, these nodes enable condition-based and predictive maintenance—reducing unplanned downtime and enabling life-extension strategies. This trend is not just about alarms; it’s about shifting maintenance culture from calendar-based replacement to data-driven intervention.

Practical implication: start with the highest-value rotating assets (critical gearboxes, main conveyors, reduction drives) for sensor retrofits and build a condition-monitoring program that ties alarms to spare-parts and response processes.

Materials, coatings and tribology improvements

To squeeze more efficiency from mechanical linkages, materials and surface treatments are being refined. High-performance alloys, case-hardened steels, nano-ceramic coatings, advanced polymers for low-friction gears and improved lubricants (including long-life synthetic greases and specialty additives) extend component life and reduce friction losses. These advances allow designers to trade weight and size against higher load capacity and lower noise—a big win where footprint and energy use both matter.

Practical implication: when upgrading a gearbox or selecting gear material, request lifecycle friction-loss data and, where applicable, test reports for coated surfaces and lubricant compatibility.

Modular, configurable designs and shorter lead times

Manufacturers are moving toward modular gearboxes, standardized mounting interfaces, and plug-and-play couplings to shorten lead times and simplify maintenance. Customization is still required, but the modular approach reduces engineering hours, speeds installation and simplifies spares stocking. This is especially important given ongoing supply-chain uncertainty and the rising cost of long lead items—modularity gives buyers options to swap standard subassemblies rather than reorder bespoke units.

Practical implication: prioritize suppliers that publish interface standards and spare-part kits; these lower total-cost-of-ownership and reduce downtime during replacements.

Additive manufacturing and lightweighting for bespoke components

Additive manufacturing (AM) is no longer niche; it is used for low-volume, high-complexity parts—custom housings, optimized gear geometries, conformal cooling passages and rapid prototyping of new transmission concepts. AM enables topological optimization that reduces mass while maintaining strength, and allows internal geometries that improve oil flow and thermal behavior.

Practical implication: use AM for prototyping and for hard-to-source replacement parts, but validate fatigue life and surface finish requirements carefully—post-processing is vital for power-transmission components.

Focus on energy efficiency and regulatory drivers

Efficiency regulations, corporate net-zero commitments and rising energy costs press plants to reduce transmission losses. Gear design refinement (optimized flank geometry), low-loss bearings and better belt technologies all contribute to system-level energy savings. Simultaneously, drives and controls that support energy-recovery and optimized scheduling multiply those gains across fleets of motors. Market forecasts show steady growth in the sector tied to industrial automation and energy-efficiency investments.

Practical implication: quantify transmission losses during design reviews—small percentage gains in gear or bearing efficiency compound into significant energy and CO₂ savings at scale.

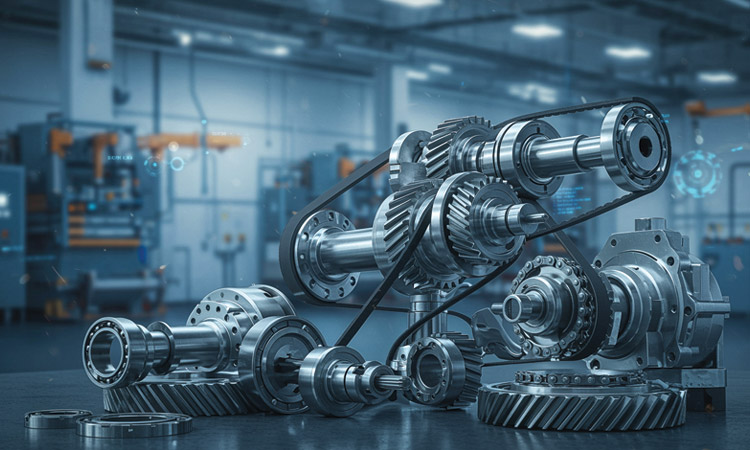

![Mechanical Power Transmission]() Belt and chain evolution—durability and low-noise focus

Belt and chain evolution—durability and low-noise focus

Belt and chain drives are not dead; they’re evolving. Synchronous belts with improved polymer compounds, advanced cord materials and low-backlash designs are extending life and reducing maintenance. Chains likewise benefit from surface treatments and precision-link manufacturing that improve fatigue life and reduce noise—important where vibration and acoustic comfort matter.

Practical implication: for retrofit projects, switching to modern synchronous belts can pay back quickly in maintenance savings and quieter operation.

Supply-chain localization and strategic investments

Recent global events exposed vulnerabilities in long supply chains for critical transmission components. Manufacturers and major buyers are responding with capacity investments, regional manufacturing and diversified sourcing for transformers, gearboxes and high-value components—moves that shorten lead times and improve resilience. These investments also spur engineering collaborations and OEM-supplier partnerships focused on local support and faster aftermarket service.

Practical implication: include lead-time and local-service criteria in procurement decisions—shorter delivery and faster field support often trump small unit-cost advantages for critical equipment.

Bringing it together: design philosophy for the next five years

The overarching theme is integration: mechanical components are increasingly evaluated as part of an electro-mechanical-IT system. Good mechanical design still matters—the geometry of gears, the metallurgy of bearings and the architecture of shafts remain foundational—but outcome-driven engineering now adds layers of sensing, communications and software that reshape lifecycle economics.

For specifiers and maintenance leaders that means a few concrete shifts: move from isolated parts procurement to system-level sourcing; demand data and openness (standard IIoT protocols) from vendors; build condition-monitoring into asset-strategy budgets; and measure success in availability and energy-per-output rather than unit-cost alone.

Investments in materials, coatings and advanced manufacturing will continue to push envelope on efficiency and compactness, while VFDs and integrated motor solutions will capture the lion’s share of near-term energy savings. Ultimately, the smart plant of the near future will look less like a set of rotating islands and more like an orchestra—mechanical components tuned by electronics and conducted through data so that the whole runs smoother, quieter and with a smaller carbon footprint.

If you’d like, I can turn this into a one-page infographic for print, prepare an equipment-spec checklist for procurement teams, or draft a short interview questionnaire for gearbox and bearing vendors to reveal how future-ready their products are. Which of those would help you most?

Quick checklist for plant engineers

- Inventory critical rotating assets and categorize by downtime risk.

- Prioritize sensor retrofits for gearboxes and main bearings.

- When replacing motors, evaluate integral-drive motors vs separate VFD+motor for lifecycle cost.

- Ask gearbox vendors for friction-loss, acoustic and thermal performance data.

- Standardize interfaces and spares where possible to reduce MTTR (mean time to repair).

- Consider AM for urgent replacement parts but validate fatigue & surface finish.

- Include energy-recovery and regenerative braking options in drive specs.

Belt and chain evolution—durability and low-noise focus

Belt and chain evolution—durability and low-noise focus