Adrian Lloyd, CEO, More Insights From Adrian Lloyd

Adrian is a 20+ year veteran of technology research and has pioneered many data analysis techniques that are used widely by analysts today. He brings his expertise to many technology markets from industrial automation products to semiconductors.

In times of economic turmoil, the machinery manufacturing sector tends to be volatile. That’s because uncertain times make factory managers inclined to postpone investment in expensive new kit. With automotive production seizing up in 2020, the machine tools market shrunk by 18% and many other categories of machinery saw sales diminish to well below 2019 levels.

But, in the case of the pandemic, the times have been so unusual, and the impacts so unpredictable, that sales in some machinery categories have grown strongly. In particular, the boom in household electronics sales driven by locked down populations, coupled with the earlier than expected return to production of the automotive sector, saw sales in semiconductor and electronics machinery grow by 8% in 2020.

Dedicated machinery for mining, farming and textiles will be growth leaders

Our research shows that the global machinery market was worth $1.98 trillion in 2020. This constituted YoY growth of about -6%. But we expect to see a 6.2% rebound in 2021 up to $2.11 trillion. Materials handling equipment is the largest segment, with a 2020 value of $275 billion. Our forecasts for the total machinery sector out to 2025 put the three highest CAGRs as mining machinery (5.3%), farming machinery (5.1%) and textile machinery (4.5%). Multi-industry machinery will have a CAGR of 3.8% over the forecast period, with materials handling equipment performing particularly well within that category (CAGR 4.7%), owing to the booming warehousing and logistics sectors.

From a regional perspective, the global machinery sector is highly consolidated, with the top five regions accounting for over 70% of global market value. China alone accounts for over 40% of the world’s machinery production. In terms of CAGR out to 2025, the USA will lead the way with a CAGR of 4.9%, followed by Italy and India with CAGRs of 4.0% and 3.7% respectively.

Materials handling equipment heading for swift recovery

Materials handling equipment can be split into four separate sub-groups: conveyors, which take up 30% of the market, escalators and lifts (30%), cranes and hoists (25%) and forklifts and other industrial trucks (15%). The fortunes of the materials handling equipment (MHE) sector are closely linked to those of general industrial production. This means that, as the global recovery accelerates, MHE will see concurrent growth. And this growth will be from a relatively strong base, given that it saw modest contraction in 2020 of only -3.8%. The sector will see 6% growth in 2021. One of the motors behind this will be the drive for greater industrial automation. Another is the sector’s universality: MHE is used across a wide range of industrial sectors.

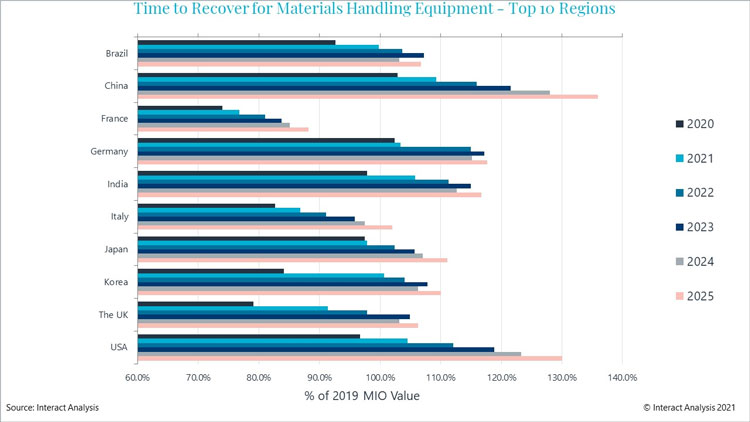

Regionally, the biggest producers of MHE are China (43.6% in 2019), the USA (10.8%) and Japan (8.5%). We expect most of the top ten regions to recover by 2025. For example, the market in China grew by a modest 3% in 2020, and will see 6.2% growth in 2021. In contrast, the data shows that the worst performer on most MHE counts will be France.

Cutting and forming machinery – automotive exposure puts a drag on recovery

The chart below describes a very different story for the cutting and forming machinery sector. As a part of the machine tools sector, and with a strong presence in the automotive industry, sales slumped by 18% in 2020 compared to 2019. We expect to see 8.4% growth in 2021: forming machinery sales will increase from $27.6 to $29.7 billion, while cutting machinery sales will jump from $59 to $65 billion.

But there are strong variations between regions. The chart shows that, in spite of the 2021 bounce back, few major regions will come close to 2019 levels in the next 5 years. The exceptions are China (the biggest cutting and forming machinery producer, accounting for 28.8% of the market in 2019), India and Brazil, and the latter two countries are only going to find recovery easier because their machine tools sectors are relatively small.

Japan, the second largest producer in 2019 (with a 23% share of the global market) has been the worst affected region due to the extent of the segment’s dependency on the automotive industry in that country. The Japanese market shrank by over 35%, and recovery will be slow, with the chip shortage putting the brakes on the automotive recovery there, as in other regions. But the Japan Machine Tool Builders Association (JMTBA) is reporting that orders are gradually recovering, with six consecutive months of orders topping 100 billion yen. France and the UK also have huge ground to make up, with cutting and forming machinery sales being slashed in 2020 by 32% and 29% respectively, with the pandemic (and possibly Brexit) complicating matters across Europe.

Meanwhile, the overall CAGR for the machine tools industry in the period 2021-2025 is forecast to be 4.1%, with cutting machinery at 2.1% and forming machinery at 3.5%.