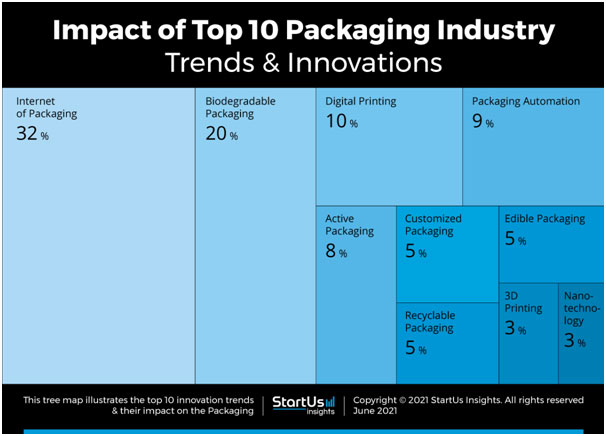

One of the rare industries which benefitted from the Coronavirus pandemic is the packaging industry. Of late, the packaging industry has been adopting smart and sustainable solutions to make product packaging more acceptable to the consumer, as well as making it brand- and environmentally-friendly. The packaging sector trends that primarily enable smart packaging are the internet of packaging, active packaging, and the use of nanotechnology. However, since the COVID-19 pandemic has kept people confined within their homes, packaging from online shopping creates the serious challenge of waste production. This problem has led to start-ups and scaleups to speed up their innovations around biodegradable, recyclable, and edible packaging. Simultaneously, the introduction of 3D printing and robotic packaging simplifies packaging processes and reduces costs for brands and consumer product companies.

Amidst the depressing economic scenario, the Indian packaging industry is expected to register a CAGR of approximately 26.7 per cent during the five-year period of 2021-2026. Once the COVID-19 pandemic was brought under control to a certain extent, most developed countries are either burning wastepaper or using it for landfill to avoid the spread of Coronavirus. This has resulted in a massive shortage of raw material for Indian paper mills. Those manufacturing Indian corrugated cardboard boxes are working hard to keep transport packaging flowing to makers of essential products, including packaging for food and other consumer products, medical and pharmaceutical products, tissue, and various hygiene products.

Moreover, the demand for packaging is increasing due to the rising population, higher income levels, changing lifestyles, increased media penetration through the internet, television, and the growing economy. As I have already mentioned earlier, it is one of the strongest growing sectors in the country. Recently published data from Care Ratings, a prominent credit rating company in India, say that more than 49 per cent of the paper produced in the country is used for packaging purposes.

The exponential growth of the market is basically driven by the pharmaceuticals and foods and beverages industries. Massive investments in the food processing, personal care, and pharmaceuticals end-user industries are making way for major opportunities for expansion of the packaging market. According to recently released data by the Associated Chambers of Commerce and Industry of India, the market size of organised packaged food reached Rs 780 million, in 2020, from Rs 530 million, in 2016.

The exponential rise in the status of the Indian middle class, the rapid penetration of organised retail, remarkable growth of exports, and India’s rising e-commerce sector is further facilitating growth. According to the Indian Institute of Packaging (IIP), the packaging consumption in India has increased by 200 per cent in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa.

In order to further maximise the potential of the packaging sector in India, the government has been continuously consulting the industry experts. In this regard, the government has asked PIAI (Packaging Industry Association of India) to formulate policies and guidelines that is expected to augment India’s export potential in the international market.

The ever-growing domestic packaging industry is primarily powered by various logistic applications, technological advancements, and similar developments across the country of the packaging sector. A recent market analysis of the Indian packaging market looked into the market segmentations based on different materials, like paper, plastic, glass, and metal. The study covered end-user producers such as food, beverage, healthcare, cosmetics, personal care, household care and other industrial segments.

The domestic food packaging industry witnessed major innovations both in terms of branding and packaging. In this context it is worth mentioning that the Bangalore-based iD Fresh has launched Smart Sip Tender Coconut and iD Grated Coconut, in imaginative eco-friendly packaging. Several established brands like Amul, Mother Dairy, Patanjali, and others, in their packaging use UV-protected films, colour-changing films, and holographic films to prevent the chance of adulterating their products.

Overall, the packaging industry is growing at a rapid pace. But packaged food in particular is the fastest-growing segment in the Indian packaging industry. It is expected to fuel the demand for plastic packaging, as it ensures food quality, safety, and long shelf life. According to the Federation of Indian Chambers of Commerce and Industry (FICCI), the expenditure on packaged foods is increasing (at inflection point), due to an increase in per capita income, urbanisation, and an increase in the number of working women. According to Agriculture and Agri-food Canada, the sales of packaged food in India amounted to $76,284.2 million in 2018, and it is expected to register a CAGR of 18 per cent during the forecast period.

Unlike western countries, the grocery market is a traditional retail industry in India. Therefore, the penetration of online retail is on the lower side. The expenditure on food and grocery accounts for 60 per cent of the total expenditure on retail in India. However, the food delivery and services market is leading to further growth in the country, with players, like Bigbasket, Grofers, Zomato, Swiggy, Scootsy, registering an exponential growth in sales. According to Ministry of Corporate Affairs study, in FY 2018 the revenue generated by Swiggy and Zomato in India was Rs 4.42 billion and Rs 4.66 billion, respectively.

Plastic bottles and jars are mostly used in the food and beverage, cosmetics and personal care, and pharmaceutical industries in India. Polyethylene terephthalate (PET) and HDPE are extensively used for manufacturing bottles and jars in India.

In an encouraging development, companies such as Bizongo, are manufacturing the first biodegradable spill-proof meal tray to promote sustainability in the packaging ecosystem. However, plastic bags are among the most used plastic packaging solutions in the country. The steadily expanding supermarket chains and Kirana stores are some major factors driving the growth of plastic bags in the country.

The top four trends in packaging are:

- Connected packaging. With more mobile devices and technologies linking packaging to the online world, connected packaging is on the up…

- Closing the loop. Recycling is far from new but consumers want more transparency and simplicity…

- Reinventing the box…

- Plastic-free.

Article by Arijit Nag

Arijit Nag is a freelance journalist who writes on various aspects of the economy and current affairs. Read more article of Arijit Nag