Rise in automation in the automotive industry, surge in need for accuracy, safety, and productivity, and reduction in labour cost in organisations drive the growth of the global automotive robotics market. However, high cost of industrial robots hampers the market growth. In fact, the emergence of industry 4.0 is projected to create lucrative opportunities for the market players in the future. And here come into play Smart Sensors and Industrial Controllers. The market for these gadgets is expected to witness a remarkable growth in the near future.

Factory automation market is expected to reach USD 442,494.8 million by 2027 witnessing a market growth at a rate of 9.60 per cent between the period of 2020 and 2027. As per a report, the global automotive robotics industry generated $6.63 billion in 2019, and is expected to reach $13.60 billion by 2027, witnessing a CAGR of 12.8 per cent from 2020 to 2027.

Last year, the Covid-19 outbreak has affected the manufacturing processes as several governments declared complete lockdown across the countries to curb the spread of the infection. The extended countrywide shutdown disrupted the supply chain, resulting in the loss of demand for automotive robotics.

The demand for automotive robotics, however, is expected to go up post-pandemic as the automotive industry, one of the major end-users of industrial robotics, is also on its way to get back on track. Since robots could help in boosting production while complying with social distancing norms, the demand for automotive robotics is expected to also increase post-pandemic.

If we go by regions, we will find the market across LAMEA, followed by North America, is expected to register the highest CAGR of 22 per cent during the forecast period of 2020 to 2027, due to incorporation of new automobile factories with installed advanced industrial robots. Moreover, way back in 2019, the global automotive robotics market across Asia-Pacific dominated, accounting for more than two-thirds of the market share, owing to rise in demand for automobiles in this geography and robots are helpful tools to increase the production rate to meet the demand.

Quality control is at the heart of any good manufacturing process and tarnished or inferior goods resulting in sunk costs at best and disgruntled or unsatisfied customers at worst. In the past, quality control has occurred after the fact with finished goods being inspected in batches to ensure they meet certain standards. However, this approach has several drawbacks. For example, if a quality defect is identified in a faulty production process, it may affect an entire batch of finished goods, meaning that they may all need to be disposed of so that the line can be run again.

Fortunately, advances in sensors and controllers are trending away from inspection after that fact and toward real-time, continuous quality assurance methodologies, which allow such prospects to be avoided. Additionally, to the use of artificial intelligence (AI) and machine learning algorithms to size up production output in real time or even predict issues in advance, more sophisticated sensors also play a significant role by providing the necessary input data.

The various metrics that manufacturers may track—particularly in process industries such as food and beverage, chemical, pharmaceuticals, or pulp and paper—include moisture. Bringing excess moisture within control is vital, not only to meet certain regulatory standards, but also to ensure proper chemical reactions and drying for pharmaceuticals, as well as maximizing shelf life and deterring mould in the food and beverage space.

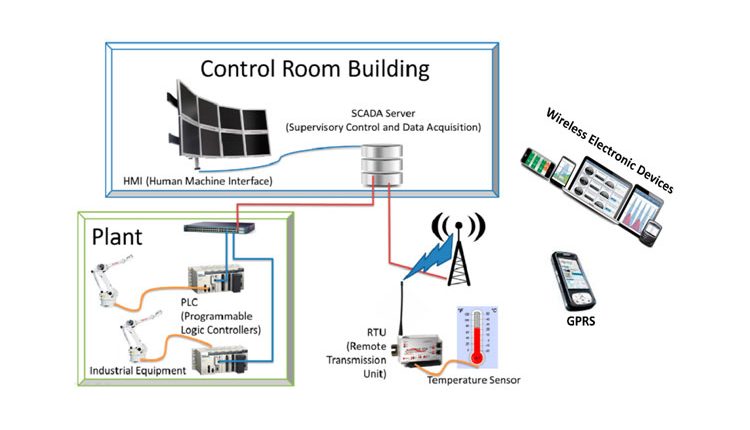

The inclination to shift process data directly from the factory floor to the digital cloud tends to create bandwidth and latency issues that can become a roadblock to real-time reporting. In order to sort out this problem, smart sensors were introduced to efficiently perform computing at the “edge” of the factory network.

The technic of processing data near the edge of your network is known as edge computing, where the data is being generated, instead of in a centralised data-processing warehouse. This technology is a distributed, open IT architecture that decentralises processing power, enabling mobile computing and Internet of Things (IoT). Incidentally, in edge computing, data is processed by the device itself or by a local computer or server, rather than transmitting to a data centre.

Moreover, edge devices reduce data loads and report meaningful, high-level results that supply real-time information. This approach allows industrial organisations to analyse essential data faster by processing machine-based data closer to the source.

Actually, early edge technology includes industrial machines, industrial controllers, data processors, and time-series databases that aggregate data from a network of equipment and sensors. Interestingly, smart sensors are a vital component of edge systems, providing a range of abilities that improve productivity in the factory and assist in driving Industry 4.0 and IIoT.

In modern production systems, smaller and more autonomous edge devices (smart sensors) are required that can run for extended periods of continuous use at the perimeter of the network. Moreover, compact smart sensors can increase the ease of system integration and device usage—both beneficial to edge system deployment.

One of the most significant benefits is that edge computing improves time-to-action and reduces latencies down to milliseconds while minimising network bandwidth. In collaboration with cloud computing and powered by smart sensor technology, these edge systems can have a profound impact on industrial system performance and ultimately increase productivity and profit for manufacturers in the days to come.

Article by Arijit Nag

Arijit Nag is a freelance journalist who writes on various aspects of the economy and current affairs.

Read more article of Arijit Nag